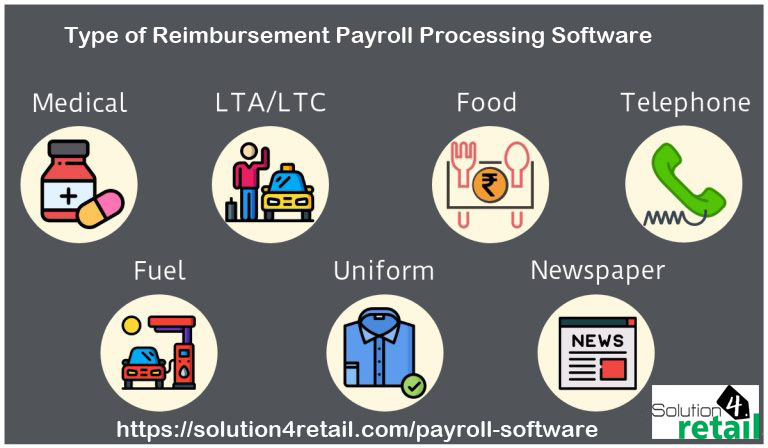

What is Reimbursement Payroll Process Software ? Reimbursement is the amount which the employee will get only after they have spent it. For an employee to claim the reimbursement, it should be defined by the company. In many cases, the employee has to produce the necessary bills in order to claim it. But first, the employee has to pay the expenditure on such heads and then a claim can be possible. If reimbursements are defined as a part of the salary, then to be able to get tax exemptions, producing the bills is necessary. Difference between Reimbursements and Allowance: An allowance is an amount given to the employees, irrespective of whether they spend it or not. Reimbursement is the amount which the employee will get only after spending the money for hospitalization, traveling etc. Types of reimbursement - ltc reimbursement rules, medical reimbursement, telephone reimbursement, fuel reimbursement Medical reimbursement: This is the reimbursement given to employees for ...