What is Reimbursement Payroll Process Software ?

What is Reimbursement Payroll Process Software ?

Reimbursement is the amount which the employee will get only after they have spent it. For an employee to claim the reimbursement, it should be defined by the company. In many cases, the employee has to produce the necessary bills in order to claim it. But first, the employee has to pay the expenditure on such heads and then a claim can be possible.

If reimbursements are defined as a part of the salary, then to be able to get tax exemptions, producing the bills is necessary.

Difference between Reimbursements and Allowance:

An allowance is an amount given to the employees, irrespective of whether they spend it or not. Reimbursement is the amount which the employee will get only after spending the money for hospitalization, traveling etc.

An allowance is an amount given to the employees, irrespective of whether they spend it or not. Reimbursement is the amount which the employee will get only after spending the money for hospitalization, traveling etc.

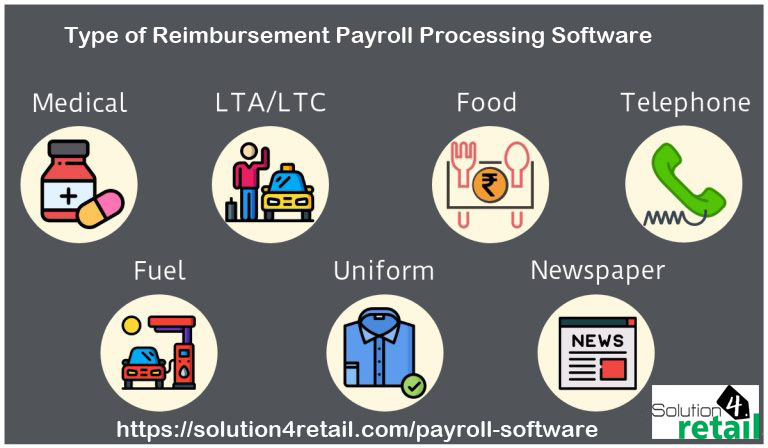

Types of reimbursement - ltc reimbursement rules, medical reimbursement, telephone reimbursement, fuel reimbursement

Medical reimbursement:

This is the reimbursement given to employees for hospitalization or medical bills.

This is the reimbursement given to employees for hospitalization or medical bills.

As of financial year 2019-20, the tax exemption of Rs. 15,000 on medical reimbursement is discontinued. Now, it comes under the general exemption of Rs. 50,000.

Leave travel allowance / conveyance (travel reimbursement)

Reimbursement of leave travel expenses incurred by the employee can be claimed as LTA. Expenditure on hotel accommodation and food does not come under LTA. Further, you can claim LTA only up to the cost of air travel in first class during your travel and is available twice in a block of four years.

Reimbursement of leave travel expenses incurred by the employee can be claimed as LTA. Expenditure on hotel accommodation and food does not come under LTA. Further, you can claim LTA only up to the cost of air travel in first class during your travel and is available twice in a block of four years.

Tax exemption: LTA amount is completely exempt to the extent of amount that has been allotted and bills produced.

LTC reimbursement rules:

You can claim LTA twice in a block period of 4 years.

One block period consists of 4 calendar years and defined by the Government. The current block period is 2019- 2021.

You can claim only one LTA in a Calendar Year as long as it is alternative years. The exception to this condition is when you have not claimed LTA in the first 2 years and you want to claim it in 3rd and 4th year.

One block period consists of 4 calendar years and defined by the Government. The current block period is 2019- 2021.

You can claim only one LTA in a Calendar Year as long as it is alternative years. The exception to this condition is when you have not claimed LTA in the first 2 years and you want to claim it in 3rd and 4th year.

If you have not claimed any LTA in one block period, you can carry forward one out of those. The carry forwarded claim must be made in the first calendar year of the next block period.

The carry forwarded claim must be made in the first calendar year of the next block period.

It is applicable on road travel via any means (4-wheeler, owned or rented; Bus), by rail (up to 1st class A/C) or by Air (economy class). Cruise and sea voyage does not come under LTA.

It is applicable on road travel via any means (4-wheeler, owned or rented; Bus), by rail (up to 1st class A/C) or by Air (economy class). Cruise and sea voyage does not come under LTA.

There is No limit on the amount (according to Govt.). You can claim the actual amount spent on travel.

Employee has to apply a minimum of 3 days of paid leave to claim LTA.

Employee has to apply a minimum of 3 days of paid leave to claim LTA.

Food coupons

Food coupons are a part of the salary. The reimbursement amount will be deducted from the salary and paid as physical or digital coupons under “Food and non-alcoholic beverages” option.

Food coupons are given on a basis of per day food for the employee. It can be 2 meals per day, with per meal costing Rs. 50. Hence, the total food coupon amount per month will be Rs. 3000 considering 30 days.

Tax exemption: The complete food coupon amount is exempt from tax.

Telephone reimbursement

Some companies also opt to reimburse the telephone bills incurred by their employees.

Conditions for telephone reimbursement: The connection should be post paid and billed in the name of the employee. This is applicable for data connection also.

Tax exemption: This is exempt up to Rs. 15000 per year or the bill amount whichever is the lower.

Fuel reimbursement

Any reimbursement for fuel charges incurred by the employee for official duty is considered as fuel or petrol reimbursement. The amount paid is up to the extent of bills produced.

Tax exemption: It is completely exempt from tax in the hands of employee and considered as an expense to employer.

Uniform reimbursements

Any reimbursement given for the purchase of official attire such as uniforms and related accessories will come under Attire reimbursements. It is paid to the extent of bills produced.

Tax exemption: It is completely exempt from tax in the hands of employee and considered as an expense to employer.

Magazine and newspaper reimbursement

It is the reimbursement amount given for any amount the employees pay towards newspaper and magazine subscription for official purposes. It can be claimed to the extent as defined by the company.

It is the reimbursement amount given for any amount the employees pay towards newspaper and magazine subscription for official purposes. It can be claimed to the extent as defined by the company.

Comments

Post a Comment