Payroll Software Gurgaon Delhi Ncr

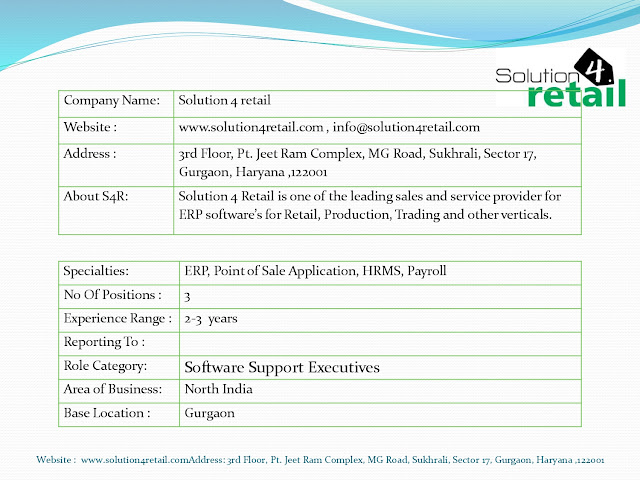

Online payroll software will change how you do business! Solution4Retail has your payroll solution. Payroll processing software has so many benefits for both small and large businesses. Most every large corporation uses a payroll service provider to ensure accuracy of their payroll. You could be doing the same thing with cost effective payroll processing software from Solution4Retail.

Salary Reports (Payslip & Salary Sheet)

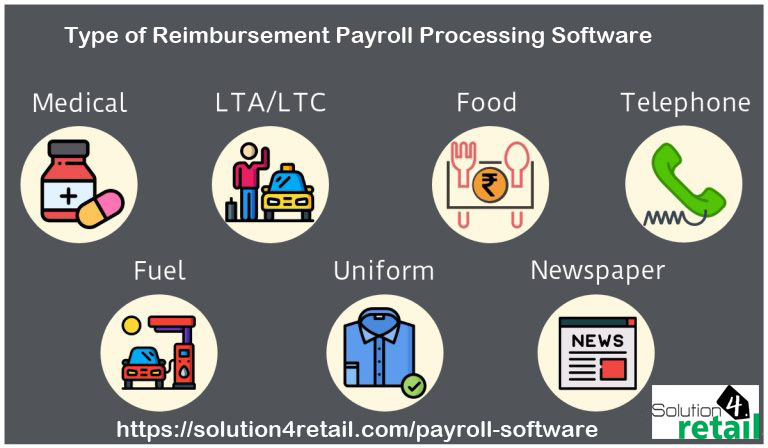

Automatically calculates all the income, deductions & Company Contributions as per the requirement Regular Payslips (with Logo) can be viewed or Emailed Reimbursement Payslips can be viewed or Emailed User defined Salary Sheets can be viewed Generates Cash / Cheque / Bank Transfer List Generate Bank Statement, Direct Electronic Bank transfer files & Covering Letter for Banks YTD salary Sheet & Summary of each employee Separate Payslips can be generated for Arrears, Medical, Reimbursement & LTA

Attendance Is Important

To help you more accurately track the attendance of your employees, we offer a variety of HRMS software solutions to meet your needs. Our leave management software makes it fast and easy to view who has taken time off and when to avoid conflicts and to accurately track pay. If you are looking for the latest way to track attendance, our biometric attendance system reduces inaccurate clocking so you always know when your employees are working and when they aren’t.

Flexible Structure building Earnings & Deductions

Flexibility to add or modify any number of Salary Components – Earnings & Deductions User Defined Entry Field with unmatched flexibility for Formula, percentage or Customized Calculation Taxable & Non Taxable Earnings for Income Tax Calculations Payslip / Non Payslip Component Calculation based on Attendance Monthly or Yearly Payments Frequency of Salary Head Also compute various other components that do not appear in Payslip

Income Tax Management

Auto calculations of Exemptions & Deductions and compute income tax payable for the entire year & the tax to be paid this month Auto calculation of TDS based on Projections Income Tax Projections with the options to deduct projected tds from Monthly Salary Prints Form 16, 12BA & Online Challan 281 Quarterly e-TDS Return as per the NSDL format Income Tax Projections can be emailed in PDF format

Full & Final Settlement

Employees Full & Final settlement can be prepared based on resignation of employees either in the current month or in the previous month Automatically calculates outstanding Loan balances, Notice pay and Leave Encashment , Gratuity and recovers all Loan balances and Income Tax. Generates Full & Final Settlement Calculation sheet for all the calculations done.

www.solution4retail.com

Comments

Post a Comment